ARLINGTON — The Arlington City Council reviewed its 2014 budget revenue options during its Monday, Sept. 30, workshop meeting, and the findings were stark.

Arlington City Admin-istrator Allen Johnson presented the City Council with two letters from the state auditor, the most recent of which is dated Sept. 17 of this year, and both of which note that the city’s financial status is insufficient to sustain its operations. Although the state auditor’s letters acknowledge the significant cuts that the city has made to try and stay in the black, Johnson added that the city still only has approximately 15 days cash on hand and a reserve fund balance of 2 percent, as opposed to its required 8 percent.

“It’s not just one year that we’re looking at trouble, but multiple years to come,” Johnson said. “Planning multiple years down the line is the only way we can do this.”

While the sales tax revenues for the past three months have shown a slightly upward trend, the city is still facing a deficit of $728,000 for 2014. Even if that trend continues, and the city made adjustments including the elimination of all contributions to the equipment replacement fund, which covers vehicles and equipment for all the city’s departments, that deficit would still be $313,208 in 2014, and would be at $302,401 in 2018, after peaking at $417,802 in 2016. Those numbers remain the same if one assumes a bond for public safety equipment.

“The budget deficit problem wouldn’t go away with a bond,” Johnson said. “We even considered raising the utility tax by the maximum allowable 3 percent, but that only solves the problem in the short term.”

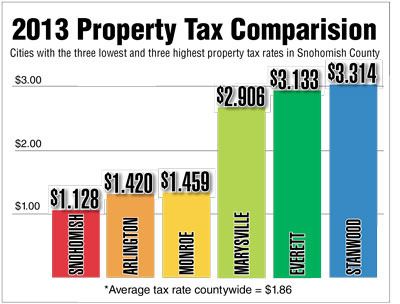

Arlington’s property tax rate is $1.42 per $1,000 of assessed valuation, the second-lowest of any city in Snohomish County, with only Snohomish itself lower, at $1.128, while Marysville is the third-highest, at $2.906. Since Arlington could be levying a maximum of $3.10, this puts Arlington at 45.8 percent of its maximum levy rate, the lowest percentage of any city in Snohomish County.

“We’re in the cellar compared to Marysville,” Johnson said. “I know we’ve historically taken pride in our low property tax rates, but it’s caught up with us.”

Johnson then introduced “Revenue Option 1,” which would not increase utility taxes, but which would adjust the property tax by 50 cents per assessed valuation — combining the public safety equipment and technology bond with the property tax adjustment — with the aims of preserving existing public services, fostering the city’s ability to grow its reserves and balancing the general fund for 10 years. Indeed, according to the budget projections presented, Option 1 would yield a budget deficit of zero in 2014, and keep the numbers in the black from a surplus of $14,290 in 2014 to that of $161,331 in 2021.

“We would address the levy lid limit by taking it to the voters,” said Johnson, who showed that this would put Arlington’s property tax rate at $1.88 per $1,000 of assessed valuation, which is only 2 cents above the county average of $1.86. “For the average home value of $173,800 in Arlington, that amounts to an increase of $7.25 per month.”

“I’ve never supported raising taxes unless it’s absolutely necessary,” Arlington City Council member Marilyn Oertle said. “But the last time we put it to the public, with the Transportation Benefit District, it was a huge success. The idea of eliminating our parks is like taking out my heart, but we should allow our citizens to make this decision.”

“The people who move to Arlington want our parks and recreation programs,” fellow City Council member Debora Nelson said. “What will happen if voters don’t pass Option 1?”

“Then some city services are simply going to have to go away,” Johnson said.

“It’s counterproductive to economic development to reduce the city’s quality of life,” said Paul Ellis, community and economic development director for the city of Arlington. “People do come here for our quality of life. That helps create an employment base of family-wage jobs.”

The Arlington City Council has set a date of March 3, 2014, to pass a resolution which would allow Arlington voters to approve Revenue Option 1 by April 22.

In the meantime, a public hearing on property taxes is set for Nov. 14, in time for an adoption date of Nov. 18, while the public hearing on the city budget is tentatively scheduled for Nov. 18, in time for an adoption of the budget on Dec. 2.